salt tax deduction explained

If your house was paid off would you take out a loan to invest it in the stock market. The change may be significant for filers who itemize deductions in high-tax states and currently can.

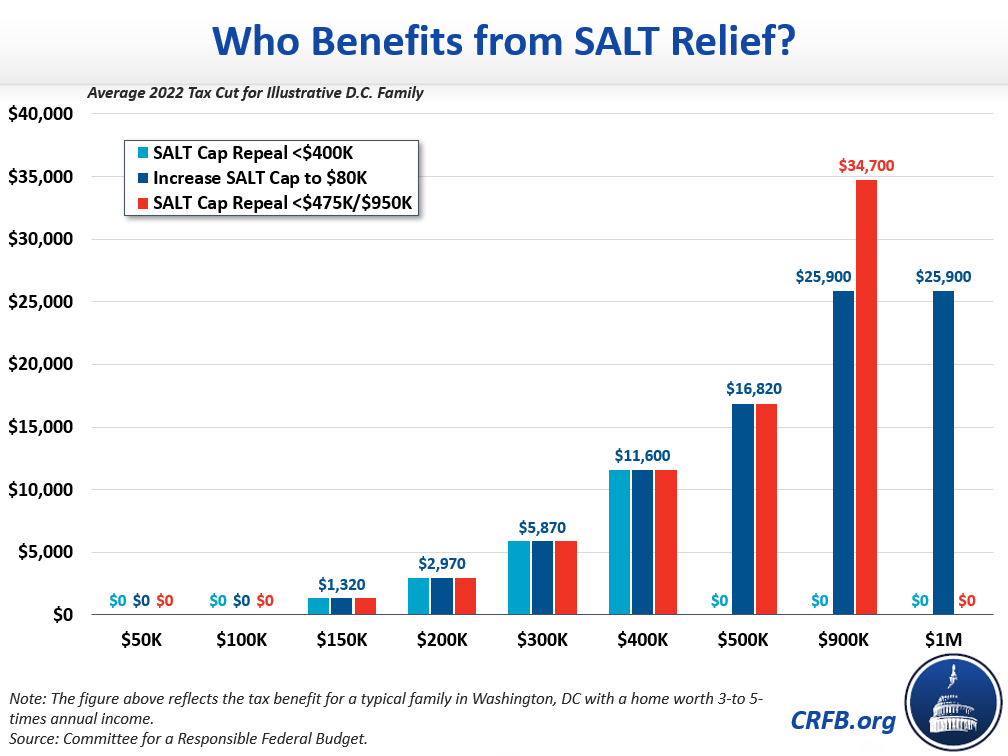

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

These provisions would raise 640 billion over.

. Notably the state and local tax deduction would be limited to a maximum deduction of 10000 for income sales and property taxes except as they are related to business activity and the mortgage interest deduction would be limited to the first 750000 in principal value. House Democrats spending package raises the SALT deduction limit to 80000 through 2030. Also due to the new State and Local Tax SALT deduction cap of 10000 as well as the increased standard deduction amounts a lot of clients are no longer itemizing their taxes in the first place.

Amazingly many people reading this would actually pause to think about it. The plan would also limit a number of deductions. General Legacy Tax Resolution Services strives to ensure that its services are accessible to people with disabilities.

Legacy Tax Resolution Services Accessibility Statement Updated. Legacy Tax Resolution Services has invested a significant amount of resources to help ensure that its website is made easier to use and more.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Tax Deduction Will Democrats Cut Taxes For The Rich Steve Forbes What S Ahead Forbes Youtube

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

How To Deduct State And Local Taxes Above Salt Cap

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Mackay Municipal Managers Muni 360 Taxi Service Rideshare New York Life

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

With Cap On Salt Deductions Lawmakers Consider Ways To Help Tax Payers Youtube

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

1930s 1940s Man Teacher Professor Looking At Camera With Pointer At Blackboard Stock Photos Masterfile Professor 1930s Men Rhetoric